Improving decisions on stock using new technology & data

Understanding the sustainability and longevity of an asset is a complex process. None more so than in the housing context when that asset is a customer’s home.

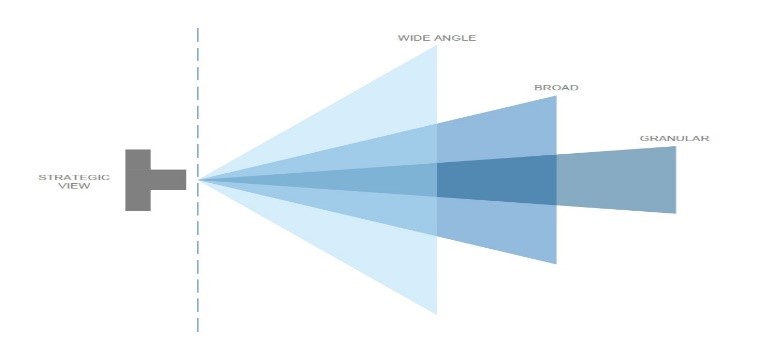

It is vital then that we have the ability to understand property and neighbourhood performance first and foremost at a granular level, (individual property), but also that we have the ability to see things in a wider context. At Thirteen we call this process looking through our ‘sustainability lens’:

- a granular lens is used to assess an individual property’s performance;

- a broader lens is used to assess a street, block or patch of properties and

- a wide-angle lens is used to assess a whole estate for example.

When assessing an asset, we consider it important to use a combination of all three lenses to fully understand how it is performing, how sustainable it is within our portfolio and the factors that may influence its categorisation.

Our portfolio is subdivided into five categories which are detailed in the following table:

|

Sustainable Category – Core & Non-core Stock |

Description & Classification Reasoning |

|

Category 1 |

30+ years sustainable life: Stock meets client / customer requirements, now and in the future. |

|

Category 2 |

15-30 years sustainable life: Stock meets current client/customer requirements in the medium term. |

|

Category 3 |

Applied where a property is performing below average or where concerns have been raised regarding its future. Sustainability evaluation outcomes used to inform potential interventions to improve performance. |

|

Category 4 |

Applied where stock is deemed to have outlived customer need or where beyond economic recovery. Option appraisal may be carried out within 1 year to determine its future. |

|

Category 5 |

Option appraisal is considered to be essential, to be completed within 6 months. Begin discussions and research around disposal options and regeneration opportunities. |

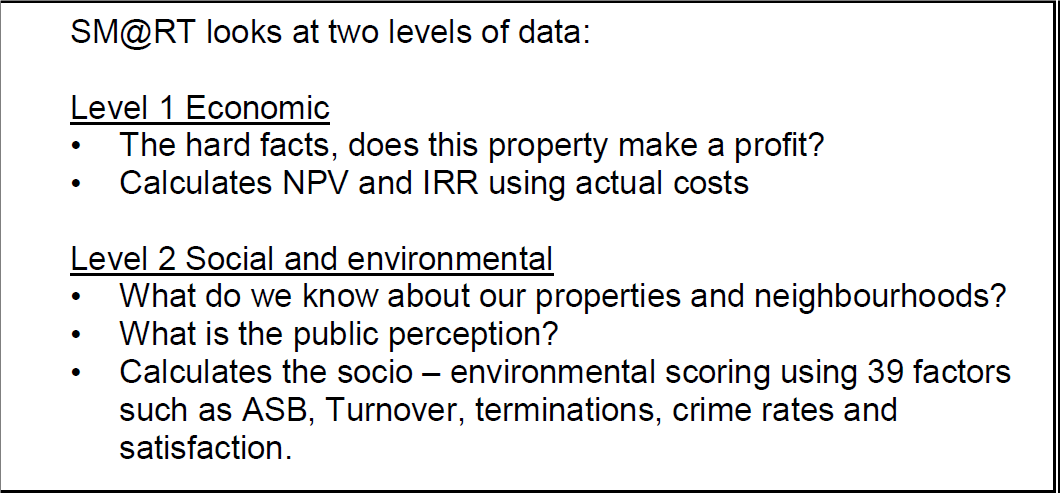

Thirteen utilise an in-house developed database called SM@RT (Sustainability, Management and Risk Tool), which allows us to understand the performance of our properties and estates. The SM@RT database uses up to date business intelligence on property and tenancy performance from Orchard Housing reports to provide individual property, street and estate level net present value (NPV), internal rate of return (IRR), sustainability scores and property sustainability categories, based on weightings derived from historic operational evidence and agreed by our cross-directorate property appraisal group. Using actual void loss, bad debt, housing management, cyclical maintenance and general maintenance data, SM@RT is able to calculate NPV outcomes using current rent levels.

SM@RT allows Thirteen to:

- Focus on neighbourhoods where investment works were planned and rearrange planned works cycles to ensure different works streams get done at the same time.

- Focus the right staffing resources in the right place at the right time.

- Analyse both asset data in conjunction with housing management to study housing estates and trends.

- Develop a neighbourhood performance league table where further research and decisions can be made on the poorer performing estates.

- Explore customer feedback on estates and learn from positive and negative comments.

- Consider external socio-economic influences on estates that can be the difference between an estate acquiring a stigma or conversely a desirable reputation for being a great place to live.

- Concentrate on providing value for money solutions for estates through performance measurement and benchmarking.

- React quickly to downward trends on estates e.g. estate minor works monies.

- Highlight issues with open land within neighbourhoods to consider future options.

- Align with local authority strategic priorities and engage with third party stakeholders with a vested interest in our communities to agree joint partnership projects.

SM@RT shines a light on the overall performance of our portfolio and why assets are underperforming or may be considered ‘unsustainable’ and, whilst it does not tell us what to do, it aides us in making informed business decisions around the asset agenda.